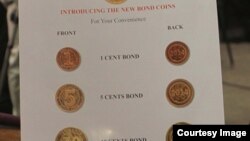

Since introduction in 2014 bond coins have remained pegged at one is to one with the US dollar, lending credence to the theory of its proponents that the proposed bond note may work as efficient as the coins.

But some economists are skeptical of the introduction of the bond notes with a value pegged against the US dollar because the country is not exporting many goods and production is at its lowest.

The central bank will also convert 40 percent of all bank deposits resulting from exports to rand, and a further 10 percent to euros, the central bank chief, John Mangudya said when announcing the launch of the notes.

Former Finance Minister Tendai Biti, who now heads the MDC-Renewal opposition party, is one of the skeptics of the new notes and said Zimbabweans would reject the new currency.

Another critic of the bond money, economist, Prosper Chitambara, said the notes will not work because the coins’ success was based on the need to use small change not any economic factors.

"I think for the bond coins was successful because it provided immediate relief to the consumer in the form of small change but when it comes to bond notes, the same cannot be said," said Chitambara.