Bond coins that were rejected by some local people and other stakeholders soon after they were introduced in Zimbabwe three months ago, have brought a lot of joy in the country’s Chinhoyi town, Mashonaland West province, where commuter bus fares have gone down by 20 cents.

But others say the coins have forced their businesses to shut down in this once productive agricultural region boasting of extensive tobacco and maize fields.

These customer calls among kombi touts have brought relief to Chinhoyi residents, who used to pay 50 cents a trip from high and low density suburbs to the town’s central business district and surrounding areas. Thanks to the Reserve Bank of Zimbabwe’s move to introduce South African-minted bond coins into the money market to facilitate the provision of change in an economy using multiple currencies such as the Chinese yuan, American dollar, British pound, South African rand, Botswana pula and several others.

Before the introduction of the bond coins, kombi operators were failing to give commuters appropriate change, resulting in rounding-off fares, a situation that forced local people to pay a lot of money when travelling to various places in the small town, of over 78,000 inhabitants.

All sectors of the economy faced the same challenges after the southern African nation dumped the Zimbabwe dollar and adopted multiple currencies in 2009.

Customers started receiving an assortment of goodies such as candy as a form of change in shops, flea markets and other trading centers.

TRANSPORT SECTOR

Now, this is a thing of the past in Chinhoyi, especially in the transport sector, as commuter bus fares have gone down from 50 cents to 30 cents a trip following the introduction of the bond coins produced at a cost of $10 million. Customers using the South African currency are now paying three rands per trip instead of five rands.

For informal trader, Mercy Kamwacha, who commutes daily from her house to the town center to conduct her business, the bond coins have brought a lot of joy to Chinhoyi residents.

“We are happy just to pay 3-rands, they were overcharging us. We also thank the coming of bond coins that has eased the change situation,” says Kamwacha.

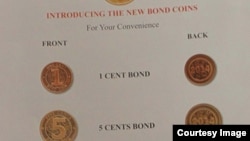

The bond coins, which have the same value as United States cents, are in denominations of one, five, 10, and 25 cents. Zimbabwe is in the process of introducing 50 cent bond coins in order to further ease the problem of change.

All this is good news for local omnibus driver, Talkmore Chiusaru, who says their challenge now is in meeting profit margins set by kombi or commuter bus operators.

“Yeah, we are now meeting targets, at least $50, $60, we are now meeting that target.”

But these coins have, however, become a curse for unregistered transport operators, who have found the going tough due to stiff competition for scarce and poorly paid customers,” he says.

PIRATE TAXIS COLLAPSE

The unregistered operators, commonly known in Chinhoyi as "go fast or tsiriyos", say they are now getting low profits following the reduction of commuter fares three weeks ago.

One of the unregistered drivers, who asked to be only identified as Taurai, is not happy at all.

He says, “ … you’ll find especially when you look at the fares, we have youngsters, who have joined the pirating business, since they can’t get employed by the government. So what this means is all youngsters who were having vehicles on rent to buy, they are no longer having the vehicles because they cannot get the money which the owners of the vehicles demand.

“So they have already surrendered the vehicles and we have very few vehicles now pirating the roads. So what it means is the number of those youngsters has increased, and actually increased the unemployment percentage which is almost about 80-90%.”

Taurai says some local youths, who were engaged in a local rent-to-buy vehicle scheme and operating pirate taxis, have been pushed out of business following the introduction of the bond coins.

“Fuel also is not going down. It is up. So they are not even getting profit from that,” he says.

TOUTS CRY FOUL

Touts too are now crying foul. One of them, who does not want to be named, says they are also struggling to make ends meet due to the reduced commuter bus fares.

“The situation is difficult now, we used to get 5-rand per car, but now we are getting only 30-cents.”

Some Zimbabweans are still resisting the use of bond coins, saying they were introduced as a way of bringing back the moribund local dollar, which became unusable due to historic hyperinflation, which the U.S-based Cato Institute estimated that it reached 89.7 sextillion percent in November 2008.

Finance houses like the International Monetary Fund put the figure at over 800 billion percent.

Central Bank governor, John Mangudya, and Finance Minister Patrick Chinamasa have insisted that the Zimbabwe dollar is not coming back into circulation anytime soon.