HARARE (Reuters) - Zimbabwe’s central bank has reassured gold companies and people receiving money transfers that they will still be able to receive foreign currency in their bank accounts after a ban takes effect in shops.

On Monday, Zimbabwe declared its interim RTGS dollar the only legal tender, ending the decade-long use of multiple currencies including the U.S. dollar.

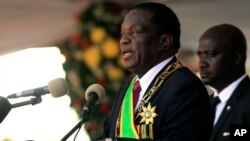

President Emmerson Mnangagwa said the move was an important step to repair the economy, but it caused uncertainty among businesses and people who rely on remittances from the large Zimbabwean diaspora.

“Authorised dealers are advised the current payment arrangements for large-scale gold producers shall continue to apply and the current retention thresholds have remained the same,” a central bank notice sent late on Tuesday said.

Gold producers operating in Zimbabwe keep 55% of their sales proceeds in foreign currency, with the remainder being surrendered to the central bank. After Monday’s currency reform, half of the balance kept by the central bank will now be sold on the interbank forex market.

Gold miners and other exporters will keep their foreign currency accounts, from which they can make international payments. For local payments, they have to liquidate their forex at the interbank market rate.

Individuals can still receive remittances in their foreign currency accounts, the central bank said.

Reporting by Nelson Banya; Editing by Elaine Hardcastle