French President Francois Hollande said Monday France will launch an investigation into French tax evaders using offshore accounts to hide their wealth, as revealed in a massive leak of information on global figures.

A team of international journalists, working with leaked documents from a Panamanian law firm, has published some of its findings into the offshore financial dealings of the rich and famous, and politically-connected, as well as the leaders of some countries. The data has become known as the Panama Papers.

Hollande said "investigations will be carried out, cases will be opened and trials will be held."

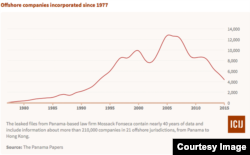

An anonymous source provided the 11.5 million documents from Panama's Mossack Fonseca law firm to the International Consortium of Investigative Journalists (ICIJ); a Washington-based organization.

The British government on Monday asked for a copy of the Panama Papers so it can do its own investigation, according to a Reuters report.

Ramon Fonseca, one of the founders of the Panamanian firm, told the French News Agency the leaking of the information to the journalists is "a crime, a felony."

"Privacy is a fundamental human right that is being eroded more and more in the modern world. Each person has a right to privacy, whether they are a king or a beggar," Fonseca said.

Tax dodging

Parking money in offshore accounts is not necessarily illegal, and can be used to establish legal tax shelters or ease international business deals. But the report said "the documents show that banks, law firms and other offshore players have often failed to follow legal requirements that they make sure their clients are not involved in criminal enterprises, tax dodging or political corruption."

The Kremlin last week did not answer questions posed by the journalists about the transactions, and it publicly accused the group of preparing a misleading "information attack" on the Russian leader and people close to him.

The International Consortium of Investigative Journalists is a nonprofit organization based in Washington, DC.

Bigger than WikiLeaks

Sueddeutsche Zeitung, based in Munich, said Sunday it received the data from an anonymous source more than a year ago. It says the amount of data it obtained is several times larger than the U.S. diplomatic cables released by WikiLeaks in 2010, and the secret intelligence documents given to journalists by Edward Snowden in 2013.

Australia's tax office told Reuters Monday it is investigating more than 800 wealthy clients of the Panama law firm for possible tax evasion.

Along with the links to Putin, ICIJ says these documents:

- Reveal the offshore holdings of 140 politicians and public officials around the world, including 12 current and former world leaders. Among them are the prime ministers of Iceland and Pakistan, the presidents of Ukraine and Argentina, and the king of Saudi Arabia.

- Include the names of at least 33 people and companies blacklisted by the U.S. government because of evidence that they’d been involved in wrongdoing, such as doing business with Mexican drug lords, terrorist organizations like Hezbollah or rogue nations like North Korea and Iran.

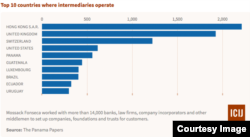

- Show how major banks have driven the creation of hard-to-trace companies in offshore havens. More than 500 banks, their subsidiaries and their branches have created more than 15,000 offshore companies for their customers through Mossack Fonseca.

The Panamanian firm told The Washington Post it follows "both the letter and spirit" of financial laws, which vary throughout the world. It said that in nearly 40 years of operation it has never been charged with criminal wrongdoing.

"This is really the shadow side of our global economy - the money that flows around mostly unchecked, undetected," Michael Hudson, a senior editor at ICIJ, said in an interview with VOA's Michael Lipin Sunday. "You can't say in every single case that someone is doing something wrong, or that they're hiding improper practices. But it certainly raises lots of questions about transparency when you have politicians, and especially top leaders of countries, moving their holdings offshore and using offshore entities to obscure what they're doing."

BVI tax haven

The report lists the British Virgin Islands as the most popular offshore tax haven, with one out of every two companies in Mossack Fonseca's files being incorporated there. Panama, the Bahamas and the Seychelles are next on the list.

ICIJ's report also sheds new light on a 1983 British gold heist that has been called the "Crime of the Century."

Robbers stole nearly 7,000 gold bars from the Brink's-Mat warehouse at London's Heathrow Airport, along with cash and diamonds. But the gold was smelted and sold, and much of the money was never recovered.

Epic heist link

The report said a Mossack Fonseca document shows that an official at a company the law firm created 16 months after the robbery was "apparently involved in the management of the money from the famous theft from Brink's-Mat in London. The company itself has not been used illegally, but it could be that the company invested money through the bank accounts and properties that was illegitimately sourced."

The law firm denied it helped conceal the proceeds of the London theft.

Michael Lipin contributed to this story